This article explains about the difference between manufacture in bond and outside bond under the Medicinal and Toilet Preparation Act 1955 with legal requirements.

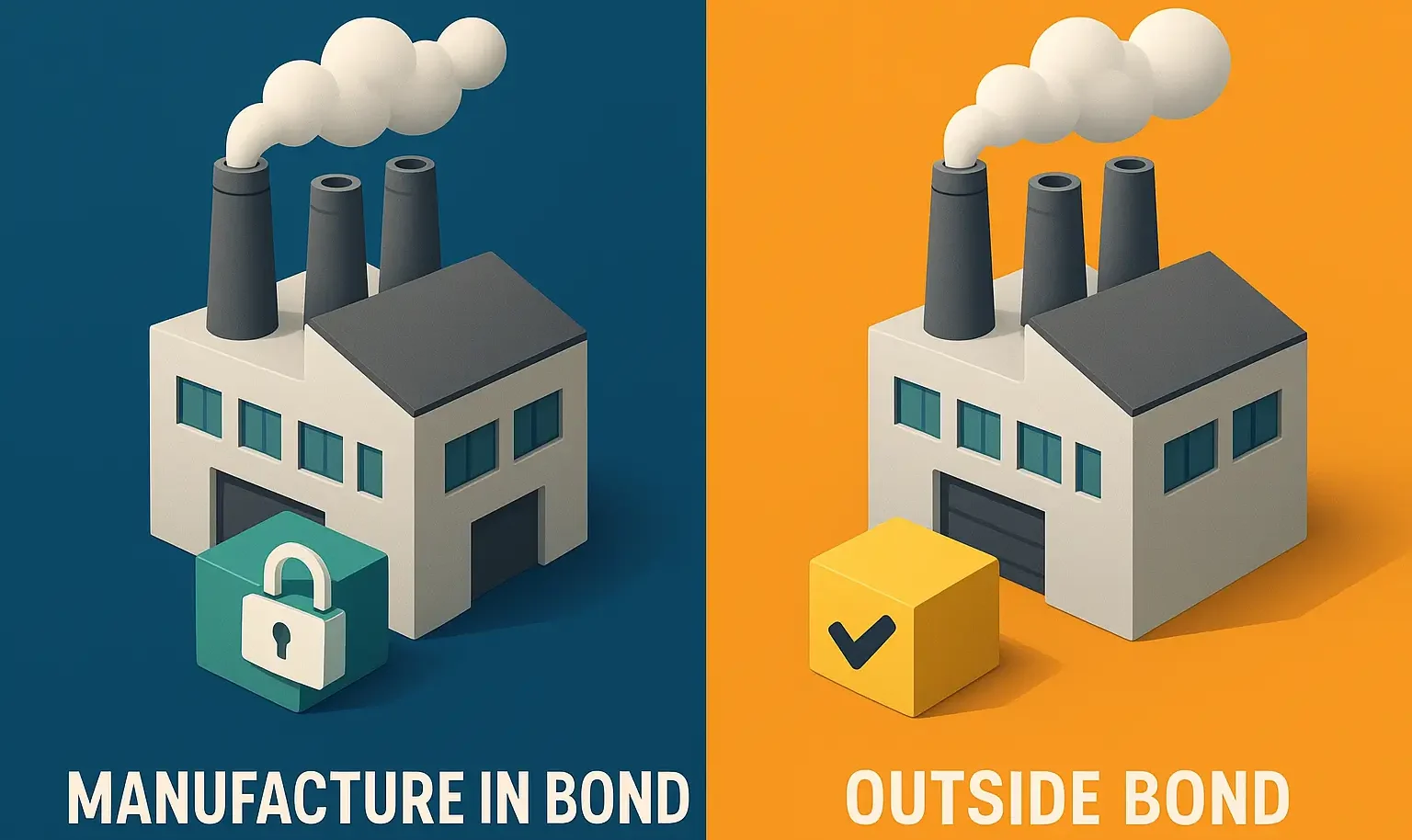

Manufacture In Bond

- Definition: Manufacturing medicinal preparations under a bond, primarily for export purposes.

-

Key Features:

- Bonded Premises: Facilities authorized to produce goods for export without immediate payment of duties or taxes.

- Tax and Duty Exemptions: Exemptions or deferments on taxes until products are sold domestically.

- Quality Control: Strict adherence to international standards for export.

- Record-Keeping: Detailed documentation of production, raw materials, and exports is mandatory.

- Regulatory Oversight: Enhanced monitoring by national and international regulatory bodies.

-

Benefits:

- Encourages export-oriented manufacturing.

- Reduces financial burden by deferring tax payments until domestic sale.

Advertisements

Manufacture Outside Bond

- Definition: Manufacturing medicinal preparations for domestic consumption within the country.

-

Key Features:

- Domestic Focus: Products intended for sale within the domestic market.

- Compliance with National Standards: Adherence to quality, safety, and labeling standards as per Indian regulations.

- Taxation: Manufacturers are liable for taxes and duties on their products.

- Quality Assurance: Implementation of Good Manufacturing Practices (GMP) for safety and efficacy.

- Distribution Control: Regulated distribution to prevent counterfeit products.

-

Benefits:

- Ensures high-quality medicines for the domestic market.

- Supports local pharmaceutical industries and economic growth.

Click Here to Watch the Best Pharma Videos

Advertisements